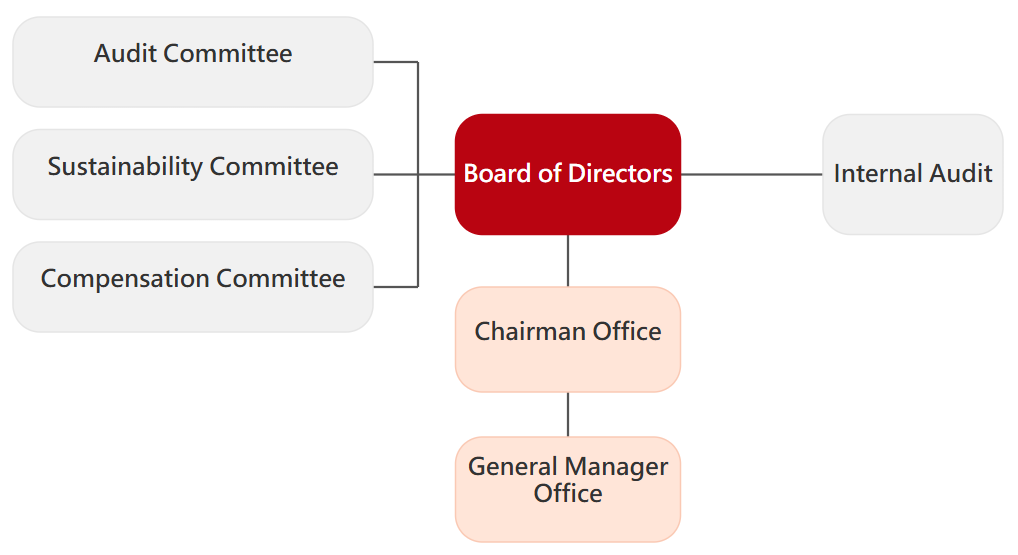

Corporate Governance Structure

The Board of Directors established the Corporate Governance Officer on May 12, 2023.

According to the resolution of the 5th meeting of the 6th Board of Directors, Ms. Chien,Yi-Ling was appointed as the Corporate Governance Officer effective March 4, 2025.

Business Execution Status

1. Handle matters related to Board of Directors and Shareholders’ Meetings in accordance with the law.

2. Prepare minutes of Board Meetings and Shareholders’ Meetings.

3. Assist directors with onboarding and ongoing training.

4. Provide directors with information necessary for the execution of their duties.

5. Assist directors in complying with applicable laws and regulations.

6. Promote and achieve the evaluation indicators of corporate governance.

7. Arrange communication between independent directors, the CPA, and the internal audit officer.

8. Report to the Board regarding directors’ and key officers’ liability insurance.

9. Conduct performance evaluations of the Board and functional committees.

2025 Training Summary of the Corporate Governance Officer

| Organizer | Course Title | Course Date | Hours |

|---|---|---|---|

| Taiwan Corporate Governance Association | Risk Management and Strategic Analysis for Corporate Sustainability | 2025/07/22 | 3 |

| Taiwan Stock Exchange | 2025 Cathay Sustainable Finance and Climate Change Summit | 2025/07/9 | 6 |

| Securities & Futures Institute (SFI) | Practical Workshop on Sustainability Disclosure for TWSE/TPEx-Listed Companies | 2025/03/20–2025/03/21 | 9 |

Board Structure

Each board member shall possess the indispensable knowledge, skill, and experience to perform their duties; the capabilities with which the Board as a whole shall equip include the followings: business acumen, knowledge of accounting and financial analysis, business management, crisis management, industry knowledge, global perspective, leadership and decision-making.

At least one among the independent directors of the Company shall be an accounting or finance professional.

Diversity of the Board of Directors: The selection and nomination of the members of the Board of Directors of the Company are in accordance with the provisions of the Company’s Articles of Association, the “Director Election Rules” and the “Corporate Governance Code”, and adopt the candidate nomination system and are selected through a fair, just and open procedure. The Company has established “Director Election Rules” and has set out the diversity policy for the composition of board members in the “Corporate Governance Code”. Based on the Company’s operating model and development needs, we formulate the professional background, professional skills, industry experience, gender, age, nationality, etc. that directors should possess, and plan the appropriate configuration of the Board of Directors and the successor candidates. Pursuant to Article 20, Paragraph 4 of the Company’s“Corporate Governance Code”, the Company’s diversity policy for the composition of its Board of Directors includes, but is not limited to, the following two aspects:

I. Basic conditions and values: gender, race, age, nationality and culture, etc.

II. Professional knowledge and skills: Professional background (such as law, accounting, industry, finance, marketing, technology, information security, risk management, corporate governance/compliance, environmental sustainability, corporate social responsibility and human rights protection), professional skills and industry experience, etc. Board members should generally possess the knowledge, skills and qualities necessary to perform their duties. In order to achieve the ideal goal of corporate governance, the Board of Directors as a whole should possess the following capabilities:

1. Operational judgment ability.

2. Accounting and financial analysis skills.

3. Operational and management capabilities (including the operation and management of subsidiaries)

4. Crisis management capabilities

5. Industry knowledge.

6. International market perspective.

7. Leadership skills.

8. Decision-making ability

In order to maintain fairness in the securities trading market, the Company has established the “Internal Material Information Disclosure and Insider Trading Prevention Procedures” in accordance with the relevant regulations of the competent authorities, and has disclosed internal rules prohibiting insider trading by insiders. These include (but are not limited to) the restriction that directors may not trade the Company’s shares during the blackout period, which is thirty days prior to the announcement of the annual financial report and fifteen days prior to the announcement of each quarterly financial report.

This year, the Company notified directors, employees, and insiders of the trading blackout periods. In accordance with the applicable regulations, the Company additionally notified directors on February 4, March 28, July 22, and September 30, 2025—i.e., 30 or 15 days prior to the announcement of the respective financial reports—regarding the trading blackout periods and the prohibition against insider trading.

Lemtech Holdings Co., Limited elected the 6th Board of Directors at the General Shareholders’ Meeting on June 18, 2024. The term of office is three years from June 18, 2024 to June 17, 2027. The 6th Board of Directors has a total of 7 seats (including 3 independent directors). In addition to the electronic components business, their professional fields cover investment management, strategic management, financial accounting, law and international market perspectives. There are 3 directors who are employees of the Company (including appointed managers) (accounting for 42.86%), there are 6 male directors (accounting for 85.71%) and 1 female director (at least 1 seat is required to meet the target; accounting for 14.29%); 1 director is over 70 years old (accounting for 14.29%), and the remaining 6 directors are under 70 years old (accounting for 85.71%). There are 3 independent directors with less than nine years of service. They have expertise in law, corporate mergers and acquisitions, and are familiar with relevant laws and business management. They can provide forward-looking, fair and important advice for the Company’s operation and development, provide advice and supervision to the “Functional Committee” under the Board of Directors, and continue to improve the experience of a more comprehensive corporate governance mechanism. This will have a positive effect on creating the Company’s overall interests and continuously improving its sustainable development rating (ESG Rating) to a leading position among global semiconductor component distributors.

| Name / Qualification | Gender/Age | Independent Directors Expiration | Business management | Leadership decision | Industry knowledge | Investment management | Human resources | Risk management | Int’l market view | Financial accounting | Law |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Hsu, Chi-Feng | Male 50~60 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Ye, Hang | Male 60~70 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Tan, Yong | Male 60~70 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Chen, Hui-Min | Male 60~70 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| Wang, Chi-Chuan | Male 60~70 | 2 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| Frank Cheng | Male 70~75 | 2 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Hsieh, Ainsley | Female 40~50 | 1 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Profiles of Board Members

| Title | Name | Date elected | Experience (education) |

|---|---|---|---|

| Chairman | Hsu, Chi-Fen | 2024.06.18 | Education: Changhua Yangming High School Current position: Chairman of Lemtech Holdings Co., Limited Experience: Deputy Manager of the Manufacturing Department, Liyau Industrial Co., Ltd. Vice President of Wei Yau Industrial |

| Director | Ye, Hang | 2024.06.18 | Education: Shanghai Electric Company Staff University Current position: Director and Chief Technology Officer (CTO) of Lemtech Holdings Co., Limited Experience: Chief of Mold Design, CA SBU, Amtek Engineering Ltd Manager of the Sales Department, Kunshan Yin Sung Machinery Co., Ltd. |

| Director | Tan, Yong | 2024.06.18 | Education: Shanghai Machine Tool Electrical Appliance Technical School Current position: Director of Lemtech Holdings Co., Limited Experience: Director of the Mold Department, Pioneer Shanghai Audio Equipment Co., Ltd. Sales Supervisor, Shanghai Jinnichi Metal Products Co., Ltd. |

| Director | Chen, Hui-Min | 2024.06.18 | Education: MBA, In-service Master’s Program, National Taiwan University Current position: Director of Lemtech Holdings Co., Limited Chairman, Huifeng Management Consulting Co., Ltd. Director of SOLARFARM CORPORATION Independent director of Wold Fitness Services Ltd Independent director of Promate Electronic Co., Ltd. Experience: CPA, Deloitte Taiwan |

| Independent Director | Wang, Chi-Chuan | 2024.06.18 | Education: Ph.D., Department of Mechanical Engineering, National Yang Ming Chiao Tung University Current position: Chair Professor, Department of Mechanical Engineering, National Yang Ming Chiao Tung University Independent director of Lemtech Holdings Co., Limited Independent director of Cryomax cooling system Independent director of King Shing Industrial Co., LTD Experience: Chair Professor, Department of Mechanical Engineering, National Yang Ming Chiao Tung University |

| Independent Director | Frank Cheng | 2024.06.18 | Education: Oklahoma Central State University MBA Current position: Independent director of Lemtech Holdings Co., Limited Experience: MSI International Co. V.P General Manager of Liuski International, Inc. |

| Independent Director | Hsieh, Ainsley | 2024.06.18 | Education: Master of Laws, New York University Current position: President, Ansili International Law Firm Independent director of Lemtech Holdings Co., Limited Independent director of TungThih Electronic Co., Ltd. Experience: Consultant of Chung-Fu Accounting Firm |

Performance Evaluation of Boards and Directors

The Company has established a performance evaluation system for the Board of Directors. In November 2019, the Board approved the “Regulations for Board Performance Evaluation” and the “Performance Evaluation System for Functional Committees” to encourage self-discipline among board and committee members and to enhance the operational effectiveness of the Board and its functional committees.

Internal performance evaluations of the Board and functional committees are conducted annually. In the fourth quarter, board members complete self-evaluations and peer evaluations, and the evaluation results are reviewed in the first quarter of the following year.

External performance evaluations of the Board are conducted at least once every three years by an external professional independent organization or a team of external experts and scholars, with the evaluation for each applicable year completed at the end of that year.

Internal Performance Evaluation

Both performance evaluation results of the Board of Directors and functional committees in 2024 were submitted to the Board of Directors on March 4, 2025. Among them, the average score of the overall Board of Directors’ self-evaluation was 96.735 points (out of 100 points); the average score of the individual director’s self-evaluation was 96.857 points (out of 100 points); the average score of the Audit Committee’s self-evaluation was 93.03

points (out of 100 points); and the average score of the committee’s self-evaluation was 93.333points (out of 100 points). The evaluation results are good, which shows the results of the Company’s efforts to strengthen the effectiveness of the Board of Directors and functional committees.

External Performance Evaluation

Major Resolutions of BOD Meetings

Year 2025

| Date | Major Resolutions |

|---|---|

| 2025.03.04 | 1. Proposal for the business report and consolidated financial statements for 2024. 2. 2024 Employee and Director Remuneration Distribution Proposal. 3. Proposal on profit distribution for 2024. 4. Proposal to change the auditor starting from the first quarter of 2025 and to assess auditor independence. 5. Proposal for the “Internal Control System Statement” for 2024. 6. Personnel changes for the Company’s Chief Financial Officer and Chief Accounting Officer. 7. Proposal to amend the Company’s Articles of Incorporation. 8. Guarantees provided by the Company. |

| 2025.05.12 | 1. Consolidated financial statements for the 1st quarter of 2025. 2. Proposal for earnings distribution for the 1st quarter of 2025. 3. Non-assurance services expected to be provided by Deloitte & Touche in 2025. 4. Proposal to amend the Company’s internal control system. 5. Guarantees provided by the Company. |

| 2025.07.15 | 1. Proposal to set the record date for capital increase from earnings and the distribution date of the new shares. 2. Guarantees provided by the Company. |

| 2025.08.21 | 1. Consolidated financial statements for the 2nd quarter of 2025. 2. Proposal for earnings distribution for the 2nd quarter of 2025. 3. Proposal to approve the Company’s 2024 Sustainability Report. 4. Proposal to amend the Company’s internal control system. 5. Guarantees provided by the Company. 6. Proposal to adjust the salary and remuneration of the Company’s managers. |

| 2025.11.13 | 1. Consolidated financial statements for the 3rd quarter of 2025. 2. Proposal for the first issuance of restricted employee shares by the Company. 3. Proposal for earnings distribution for the 3rd quarter of 2025. 4. Proposal to establish the scope and key themes of the Company’s 2025 Sustainability Report. 5. Proposal to amend the Company’s internal control system. 6. Guarantees provided by the Company. |

| 2025.12.18 | 1.Proposal for the Company’s budget for fiscal year 2026. 2.Proposal for the disposal of the Company’s equity interest in Lemtech Electronics Technology (Changshu) Co., Ltd (hereinafter referred to as “LET (CS)”), in response to adjustments in the Company’s operating strategy, and for the recognition of related impairment losses in accordance with International Financial Reporting Standard No. 5 (IFRS 5). 3.Proposal for the Company to apply for credit facilities with banks. 4.Proposal for amendments to the terms and conditions of guarantees and endorsements provided by the Company. 5.Proposal for the distribution of year-end bonuses to managerial officers for fiscal year 2025. |

Year 2024

| Date | Major Resolutions |

|---|---|

| 2024.03.04 | 1. Proposal for the business report and consolidated financial statements for 2023. 2. Proposal on profit distribution for 2023. 3. Proposal to distribute cash dividends to shareholders in the 4th quarter of 2023. 4. Proposal for the “Internal Control System Statement” for 2023. 5. Proposal for revision of internal control measures. 6. 2023 Employee and Director Remuneration Distribution Proposal. |

| 2024.05.06 | 1. Consolidated financial statements for the 1st quarter of 2024. 2. Proposed issuance of common stock through private placement. 3. To formulate general principles for the Company’s policy on pre-approval of non-confidential services. 4. To revise the internal control procedures. 5. Guarantees provided by the Company. |

| 2024.08.20 | 1. Consolidated financial statements for the 2nd quarter of 2024. 2. The Company plans to set up a factory in Thailand. 3. The Company plans to set up a factory in Malaysia. 4. Guarantees provided by the Company. 5. To revise the internal control procedures. 6. Proposal to adjust the salary and remuneration of the Company’s managers. |

| 2024.11.11 | 1. Consolidated financial statements for the 3rd quarter of 2024. 2. The Company intends to increase its investment in Lemtech Mexico S.A. de C.V. |

| 2024.12.19 | 1. The Company’s 2025 budget. 2. 2025 internal audit plan. 3. The Company regularly evaluates the independence of the certified public accountants. 4. The Company intends to dispose of the Zhongli (Taoyuan City) factory land. 5. Proposal for the appointment of a new “Information Technology Director” of the Company. 6. Proposal on the payment of year-end bonuses to managers in 2024. |

Audit Committee

The Audit Committee assists the Board of Directors in performing its supervision functions. It is also responsible for tasks defined by the Company Act, Securities and Exchange Act and other relevant regulations.

The Committee’s duty and responsibility includes the following items: supervising the financial reporting of the Company, internal audit, internal control of the Company, material transactions of assets and derivatives, loans, endorsements, guarantees, engaging and removing the Company’s independent auditors and accessing such auditors’ compensation and independence, and appointing or removing managers of finance, accounting and internal audit divisions.

Members of Audit Committee

| Title | Name | Date of on board |

|---|---|---|

| Independent Director | Wang Chi-chuan (Convener) | 2024/6/18 |

| Independent Director | Frank, Cheng | 2024/6/18 |

| Independent Director | Ainsley, Hsieh | 2024/6/18 |

Communication Between Independent Directors and the CPA (Certified Public Accountant)

| Date | Communication Method | Communication Topics | Recommendations & Conclusions |

|---|---|---|---|

| 2025.03.04 | 6th Term, 5th Audit Committee Meeting | Explanation and communication of the audit results of the 2024 Annual Financial Statements. | No objections. The financial report was submitted to the Board for discussion, approved by all attending directors, and then reported to the competent authority. |

| 2025.05.12 | 6th Term, 6th Audit Committee Meeting | Explanation and communication of the audit results of the 2025 Q1 Financial Statements. | No objections. The financial report was submitted to the Board for discussion, approved by all attending directors, and then reported to the competent authority. |

| 2025.08.21 | 6th Term, 8th Audit Committee Meeting | Explanation and communication of the audit results of the 2025 Q2 Financial Statements. | No objections. The financial report was submitted to the Board for discussion, approved by all attending directors, and then reported to the competent authority. |

| 2025.11.13 | 6th Term, 9th Audit Committee Meeting | Explanation and communication of the audit results of the 2025 Q3 Financial Statements. | No objections. The financial report was submitted to the Board for discussion, approved by all attending directors, and then reported to the competent authority. |

Compensation Committee

The Remuneration Committee assists the Board in discharging its responsibilities related to Lemtech’s compensation and benefits policies, plans and programs, and in the evaluation and compensation of Lemtech’s directors of the Board and executives.

The members of the Remuneration Committee are appointed by the Board as required by R.O.C. law. According to Lemtech’s Remuneration Committee Charter, the Committee shall consist of no fewer than three independent directors of the Board.

Remuneration Committee Responsibilities:

- To regularly review these Procedures and propose recommendations for amendments.

- To formulate and regularly review the performance evaluation criteria, annual and long-term performance objectives for the Company’s directors, independent directors, and managerial officers, as well as remuneration policies, systems, standards, and structures.

- To regularly evaluate the extent to which the performance objectives of the Company’s directors, independent directors, and managerial officers have been achieved, and, based on the results of such performance evaluations, to determine the content and amounts of their individual remuneration.

Members of the Compensation Committee

| Title | Name | Date of on board |

|---|---|---|

| Independent Director | Frank, Cheng (Convener) | 2024/18/6 |

| Independent Director | Wang, Chi-Chuan | 2024/18/6 |

| Independent Director | Ainsley, Hsieh | 2024/18/6 |

Sustainability Development Committee

Lemtech Holdings formally established the Sustainability Development Committee in 2024 under the Board of Directors, the Company’s highest governance authority. The Committee is chaired by the Group General Manager, demonstrating senior management’s commitment and emphasis on sustainability issues.

The Board conducts an annual review and provides guidance on the execution of sustainability action plans and impact management.

The Company’s Sustainability Development Committee consists of three members, including one director responsible for oversight. All committee members possess professional knowledge and competencies related to sustainable development.

The Committee is responsible for establishing sustainability policies, formulating annual action plans, supervising implementation, reviewing the sustainability report, and promoting and overseeing sustainability-related systems and disclosure matters. The Committee reports regularly to the Board of Directors on progress and key achievements.

Members of the Sustainability Development Committee

| Position | Name | Sustainability Expertise & Competencies | Attendance Rate (Including Proxy Attendance) |

|---|---|---|---|

| Chair & Convener (General Manager) | Ricky,Eu | Corporate operations and risk management | 100% |

| Member (Chairperson) | Hsu, Chi-Feng | Industry sustainability development and trend management | 100% |

| Member (Corporate Governance Officer) | Chien, Yi-Ling | Corporate governance and regulatory compliance | 100% |

Internal Audit

Purpose of Internal Audit

To promote sound corporate operations and the establishment of an effective internal control system, the Internal Audit function assists the Board of Directors and management in evaluating and reviewing internal control deficiencies, assessing the effectiveness and efficiency of operations, and providing timely recommendations for improvement, thereby ensuring the continuous and effective implementation of the internal control system.

Internal Audit Organization

The Audit Office of our company is subordinate to the Board of Directors and is staffed with one dedicated Chief Auditor. Audit personnel are allocated in accordance with the scale, business operations, management needs of each subsidiary within the Group, and relevant laws and regulations.

Internal Audit Operation

- Based on the results of risk assessments, the Internal Audit Office formulates an annual audit plan, which is submitted to the Board of Directors for approval. Audits are conducted in accordance with the approved audit plan, and special audit projects may also be arranged on an ad hoc basis in response to operational needs.

- The Internal Audit Office communicates audit findings with the audited units in a timely and adequate manner. Audit results are faithfully disclosed in audit reports and submitted to the Chairman for review. Where deficiencies or irregularities are identified, the Internal Audit Office provides recommendations, coordinates with the relevant units to implement corrective actions, and conducts periodic follow-up on the status of such improvements.

- Audit reports and follow-up reports are submitted to the Independent Directors (i.e., the Audit Committee) on a monthly basis for review. In accordance with applicable regulations, the Chief Audit Officer also attends meetings of the Board of Directors and the Audit Committee to present audit reports.

- Each year, the Internal Audit Office reviews the self-assessment reports submitted by the Company’s various departments and subsidiaries. Together with the identified internal control deficiencies, irregularities, and the status of corrective actions, the results are provided to the Board of Directors and the President as a basis for evaluating the overall effectiveness of the internal control system and for issuing the Internal Control Statement.

Appointment, Evaluation, and Compensation of Internal Audit Personnel

The appointment and dismissal of the Chief Audit Officer are subject to the consent of the Audit Committee and are submitted to the Board of Directors for resolution. In accordance with the Company’s Corporate Governance Best Practice Principles, the appointment, evaluation, and remuneration of internal audit personnel are approved by the Chairman upon submission by the Chief Audit Officer.

Communication Between Independent Directors and the Chief Audit Officer

| Date | Communication Method | Communication Matters | Recommendations & Conclusions |

|---|---|---|---|

| 2025.03.04 | 6th Term, 5th Audit Committee Meeting | Execution status of audit operations from December 2024 to February 2025. 2024 Internal Control System Statement. | Acknowledged; no objections. |

| 2025.05.12 | 6th Term, 6th Audit Committee Meeting | Execution status of audit operations for March–April 2025. | Acknowledged; no objections. |

| 2025.07.15 | 6th Term, 7th Audit Committee Meeting | Execution status of audit operations for May–June 2025. | Acknowledged; no objections. |

| 2025.08.21 | 6th Term, 8th Audit Committee Meeting | Execution status of audit operations for July 2025. | Acknowledged; no objections. |

| 2025.11.13 | 6th Term, 9th Audit Committee Meeting | Execution status of audit operations for August–October 2025. | Acknowledged; no objections. |

| 2025.12.18 | 6th Term, 10th Audit Committee Meeting | Annual Internal Audit Report | Acknowledged; no objections. |

Corporate Integrity Management Office

The establishment of this Complaint/Whistleblowing Policy is intended to effectively manage internal and external channels for reporting ethical misconduct, thereby ensuring the implementation of the Company’s commitment to ethical business practices and protecting the legitimate rights and interests of whistleblowers. The Company has instituted confidential reporting mechanisms to enable stakeholders—including customers, shareholders, government agencies, the community, suppliers, employees, business partners, and the general public—to report or file complaints regarding fraudulent activities, unethical conduct (such as corruption or bribery), or any actual or potential violations of laws and/or Company policies.Through these channels, designated case handlers appointed by the Investigation Committee will regularly update whistleblowers on the status of their cases. Furthermore, senior management meetings will periodically review and monitor the progress and control of case handling to ensure proper oversight.

The Corporate Governance Department serves as the Company’s dedicated unit for maintaining and updating the “Procedures for Ethical Corporate Management and Guidelines for Conduct.” The department is responsible for implementing the policy, providing interpretations and consultation, managing documentation, and overseeing all related reporting processes.

Each department, within its area of responsibility, plays an active role in carrying out the Company’s integrity policies and preventive measures to ensure that ethical standards are fully upheld across the organization.

Every year, the Corporate Governance Department presents a report to the Board of Directors on the integrity management results from the previous year.

Whistleblowing Channel

In accordance with LemTech’s“Stakeholder Complaints and Whistleblowing Policy,” a dedicated email channel—whistleblower@lemtech.com

—is available for all internal and external stakeholders to report concerns or provide feedback. All submissions are jointly received by the Group GM and the Corporate Governance Department.

LemTech is committed to protecting the identity of whistleblowers and conducts all investigations with strict confidentiality. When necessary, relevant departments will be assembled to form an investigation team. The team handles every report and subsequent investigation with the highest level of discretion and professionalism.

The Company has duly implemented its Integrity Management Policy. The status of implementation for the year 2024 was reported to the Board of Directors on May 12, 2025.

Business Implementation

| Supplier Commitment (Taiwan Region) | A total of 151 out of 280 suppliers (81%) have signed the Supplier Integrity Agreement |

| Education and Training (Headquarters) | Personal Data Protection Training Completed 74% |

| Commitments (Taiwan Region) | 100% of new employees sign the Global Employee Integrity and Professional Ethics Agreement upon onboarding. |

| Awareness & Education | Whistleblowing System – Reporting & Complaint Email : whistleblower@lemtech.com |

Upon appointment, new directors, managers, and insiders receive education and promotion regarding the prohibition of insider trading, covering the scope and subjects of insider trading prohibition, the scope of information that may materially affect stock prices and its disclosure methods, penalties, and relevant legal provisions.

Implementation Status for 2025: In 2025, the Company reminded via email the Board of Directors meeting dates for the annual financial reports of the year, simultaneously reminding insiders not to trade the Company’s stock during the blackout period of 30 days prior to the annual financial report announcement and 15 days prior to each quarterly financial report announcement, and detailed the specific dates of the stock trading blackout periods to prevent directors from inadvertently violating the regulations.

Internal Policies

| No | Subject | Download |

|---|---|---|

| Organizational structure | Corporate governance organizational structure | |

| 1 | Articles of Incorporation | |

| 2 | Rules and Procedure for Shareholders Meetings | |

| 3 | Procedures for Election of Directors | |

| 4 | Rules Governing the Scope of Powers of Independent Directors | |

| 5 | Procedures for Acquisition or Disposal of Asset | |

| 6 | Rules and Procedure for Directors Meetings | |

| 7 | Procedures for Endorsement & Guarantee | |

| 8 | Procedures for Lending Capital to other Parties | |

| 9 | Code of Ethics for Directors and Officers | |

| 10 | Audit Committee Charter | |

| 11 | Remuneration Committee Charter | |

| 12 | Procedures for Ethical Management and Guidelines for Conduct | |

| 13 | Practical Code for Corporate Society | |

| 14 | Procedure for spokesperson and deputy | |

| 15 | Procedures for Handling Material Inside Information | |

| 16 | Practice Principle of Corporate Governance | |

| 17 | Regulations for the Evaluation of the Board of Directors and Functional Committees | |

| 18 | Sustainability Development Committee Charter | |

| 19 | Standard Operating Procedures for Handling Directors' Requests | |

| 20 | Standard Operating Procedures for Handling Directors' Requests | |

| 21 | Procedures for Stakeholder Complaints and Whistleblowing | |

| 22 | Personal Data Protection Management Regulations |